- Download Free Financial Accounting Trial Balance Example For Clothes Shops

- Download Free Financial Accounting Trial Balance Example Debits And Credits

Debit side of the trial balance b. Credit side of the trial balance c. Not on the trial balance d. Debit and credit side of the trial balance ANS: A PTS: 1 DIF: Difficulty: Easy OBJ: LO: 2-5 NAT: AACSB: Reflective Thinking STA: AICPA-FN: Measurement ACBSP: Recording Transactions KEY: Bloom's: Comprehension 38. Oct 13, 2020 Download the Financial Sample Excel workbook for Power BI.; 2 minutes to read; m; v; In this article. Need some data to try with the Power BI service? We have a simple Excel workbook of sample financial data. This workbook has a table of sales and profit data sorted by market segment and country. Download it directly. Dec 04, 2017 Download ready to use a free excel template trial balance for help and become efficient in your accounts. On the subject of this business people and managers utilize checkbook registers to count recorded exchanges with account explanations issued by the bank toward the finish of the month. Download Free Financial Statement Templates in Excel. Create and manage financial statements for final accounts of your company or for your clients. Now you can use MS Excel to do final accounts and create financial statements like Income Statements, Balance Sheet, Cash Flow Statement and more. All excel templates are free to download and use.

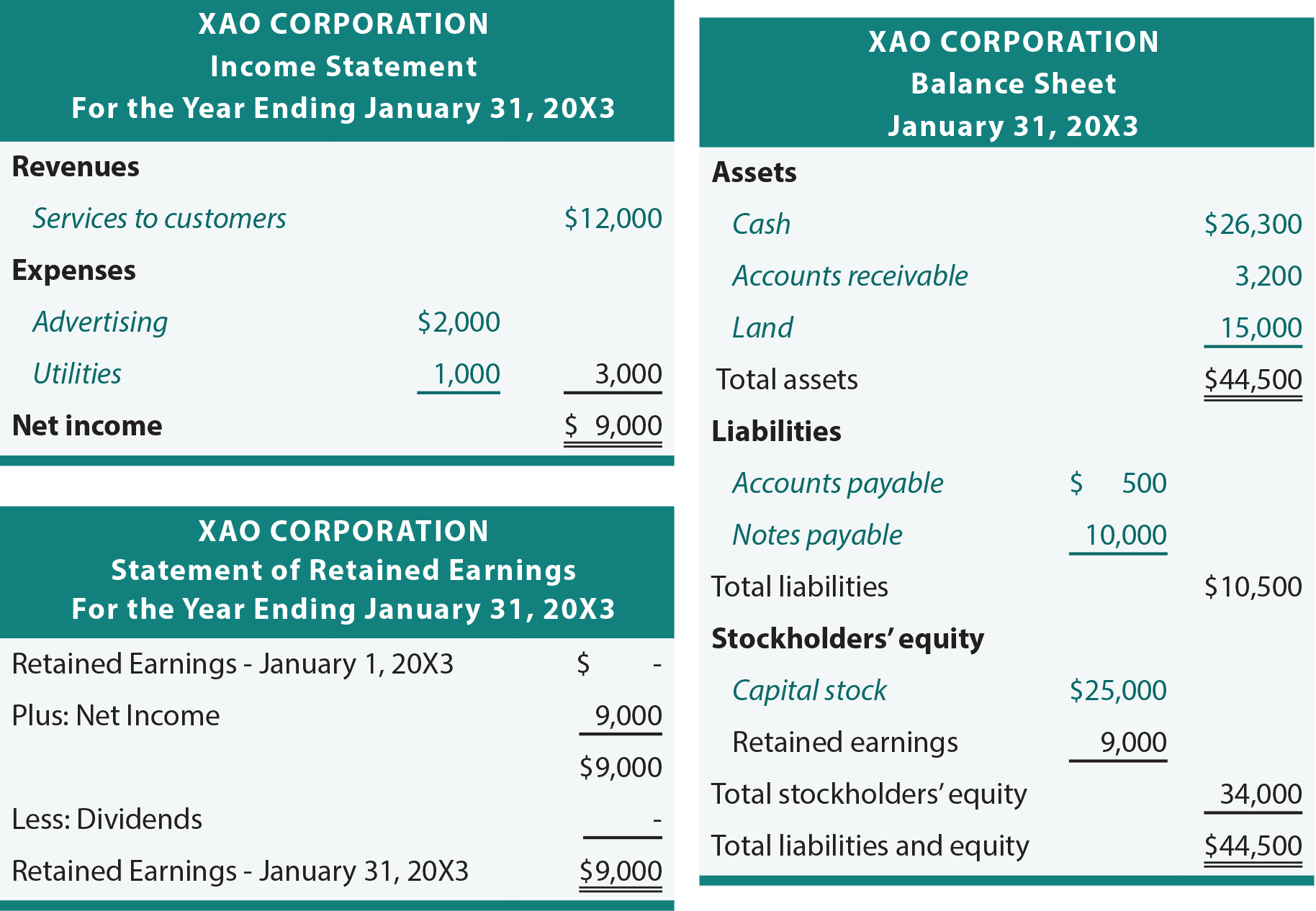

The last two steps in the accounting process are preparing a trial balance and then preparing the balance sheet and income statement. This information is provided in order to communicate the financial position of the entity to interested parties.

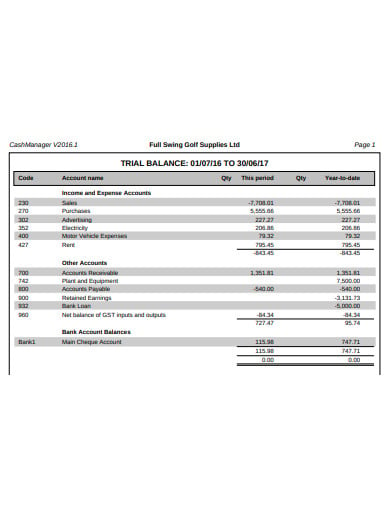

TRIAL BALANCE

Download Free Financial Accounting Trial Balance Example For Clothes Shops

A trial balance is a list and total of all the debit and credit accounts for an entity for a given period – usually a month. The format of the trial balance is a two-column schedule with all the debit balances listed in one column and all the credit balances listed in the other. The trial balance is prepared after all the transactions for the period have been journalized and posted to the General Ledger.

Key to preparing a trial balance is making sure that all the account balances are listed under the correct column. The appropriate columns are as follows:

Assets = Debit balance

Liabilities = Credit balance

Expenses = Debit Balance

Equity = Credit balance

Revenue = Credit balance

Should an account have a negative balance, it is represented as a negative number in the appropriate column. For example, if the company is $500 into the overdraft in the checking account the balance would be entered as -$500 or ($500) in the debit column. The $500 negative balance is NOT listed in the credit column.

Example Trial Balance:

Download Free Financial Accounting Trial Balance Example Debits And Credits

The trial balance ensures that the debits equal the credits. It is important to note that just because the trial balance balances, does not mean that the accounts are correct or that mistakes did not occur. There might have been transactions missed or items entered in the wrong account – for example increasing the wrong asset account when a purchase is made or the wrong expense account when a payment is made. Another potential error is that a transaction was entered twice. Nevertheless, once the trial balance is prepared and the debits and credits balance, the next step is to prepare the financial statements.

Income Statement

The income statement is prepared using the revenue and expense accounts from the trial balance. If an income statement is prepared before an entity’s year-end or before adjusting entries (discussed in future lessons) it is called an interim income statement. The income statement needs to be prepared before the balance sheet because the net income amount is needed in order to fill-out the equity section of the balance sheet. The net income relates to the increase (or in the case of a net loss, the decrease) in owner’s equity.

Now that the net income for the period has been calculated, the balance sheet can be prepared using the asset and liability accounts and by including the net income with the other equity accounts.

When preparing balance sheets there are two formats you can use. The format above is called the Report form and the Account form lists assets on the left side and liabilities and equity on the right side.

For a teaching lesson plan for this lesson see:

Trial Balance and Financial Statement Preparation Lesson Plan

Related posts:

- What Are Debits and Credits? Understanding accounting debits and credits....

- Your Accounting Statement of Cash Flows No, it is not an overdraft notice from the bank. Your statement of cash flows is...

- Understanding Accounting: Accounts Payable Function The accounts payable function of accounting is an area that requires close monitoring and accurate...

- Accrual Accounting and Adjusting Entries Businesses go through a series of financial transactions that occur on a continuous basis within...